- Southern Governments Raise Concerns

- Federal Balance Under Scrutiny

- Dispute Over Tax Sharing

Article Today, Hyderabad:

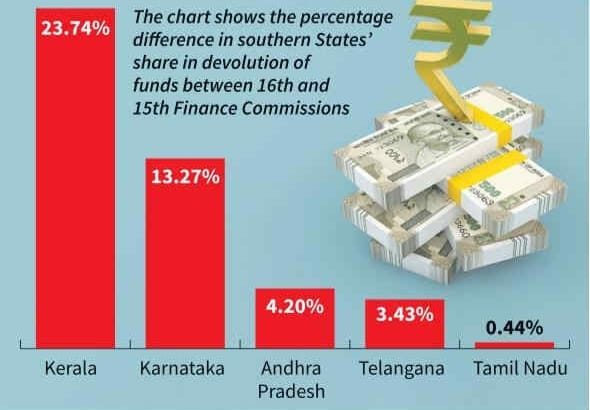

The recommendations of the Sixteenth Finance Commission have triggered sharp political debate across southern India. Variations in the proposed tax devolution among States have raised questions about equity and federal balance. Several southern governments have argued that the distribution does not adequately reflect their contribution to the national exchequer.

Tamil Nadu Voices Concern

Tamil Nadu has emerged as one of the most vocal critics of the proposed allocation. Its share has risen only marginally compared to the Fifteenth Finance Commission period, despite the State being among the country’s leading contributors in tax revenue. Therefore, the State government has expressed dissatisfaction, stating that the increase does not match its economic performance or fiscal discipline.

Telugu States Feel Marginalised

Meanwhile, both Andhra Pradesh and Telangana have flagged what they describe as continued neglect. Andhra Pradesh, still coping with post-bifurcation financial stress, has seen only a modest rise in its share. Telangana has also recorded limited growth in allocation, prompting concerns that fast-growing urban economies such as Hyderabad are not being adequately factored into the formula.

Kerala Sees Sharp Rise

In contrast, Kerala has registered a substantial increase in its share under the new recommendations. The scale of the rise has placed the State among the top beneficiaries nationwide. This has attracted attention, especially as Kerala has often highlighted fiscal strain in its engagements with the Centre.

Karnataka Gains Significantly

In addition, Karnataka has recorded a double-digit increase in its allocation. As a major hub for information technology and manufacturing, the State’s improved share has been viewed by some as recognition of its revenue contribution. However, comparisons with neighbouring States have intensified questions about the criteria applied.

National Pattern Emerges

At the national level, variations in allocation across States have drawn wider scrutiny. Some States have seen sharp increases, while others have recorded only marginal gains. This uneven pattern has revived debate over whether fiscal performance, population control, and development indicators are being balanced appropriately.

Political Implications Ahead

Consequently, the proposed tax devolution has begun to influence regional political discourse. Southern States have argued that disciplined governance and economic growth should not result in reduced fiscal support. As discussions continue, the Finance Commission’s recommendations are expected to remain a key issue in Centre–State relations in the coming months.