Article Today, Hyderabad:

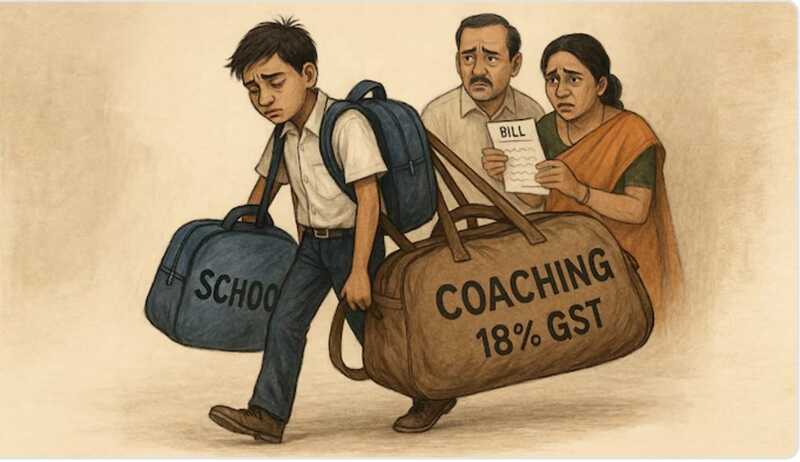

Middle-class families now face an added challenge as the government has imposed 18% Goods and Services Tax (GST) on private coaching centres and online tutorials. While schools and colleges remain outside the tax net, coaching institutions have not been classified as educational institutions, placing them within the ambit of GST. Parents fear this move will increase expenses at a time when competition for entrance examinations is already intense.

Why Coaching Thrives

Coaching has become a necessity rather than an option. Since the 1990s, local tuition culture has transformed into a multi-crore industry. Rising competition, especially in national-level entrance exams like JEE and NEET, and a lack of trust in classroom teaching have pushed students into coaching centres. A report by Infinium Global Research estimates that the coaching industry, valued at Rs.58,000 crore, may grow to Rs.1.34 lakh crore by 2028, showing the scale of this demand.

Urban-Rural Gap

According to the CMS Education Survey, one in every three students in India attends coaching classes. In urban areas, the share is 30.7%, while in rural regions it stands at 25.5%. Annual expenditure reflects this gap. On average, a student in an urban area spends Rs.3,988 per year, while a rural student spends Rs.1,793. At the higher secondary level, costs rise significantly, touching Rs.6,384 per student. These figures highlight the financial stress on families, particularly those from middle-income backgrounds.

Reluctance to Give up Coaching

Despite the tax, parents are unlikely to withdraw children from coaching classes. The fear of falling behind in a competitive environment continues to drive enrolments. Many families view the additional expense as an unavoidable investment in their children’s future, even if it increases financial strain. Surveys suggest that the tax alone will not reduce reliance on coaching.

Regulations Not Enforced

The government has earlier attempted to regulate coaching centres by introducing guidelines on misleading advertisements, false rank guarantees, and age restrictions for admissions. The Ministry of Education, the Central Consumer Protection Authority, and the Advertising Standards Council of India have all issued directions. However, enforcement has been weak, allowing institutions to operate without accountability.

Need for Systemic Change

Experts argue that the GST will not resolve the deeper issues that fuel dependence on coaching. The problem lies in gaps within school education. Strengthening remedial classes, training teachers effectively, and integrating exam preparation into schools could reduce reliance on external coaching. In addition, promoting free online learning tools and AI-based study platforms could provide accessible alternatives. Until such reforms take shape, families are expected to bear the burden of higher costs while continuing to depend on coaching for academic success.