- Protection for \ Jewellery, Events

- Financial Safety for Families

Article Today, Hyderabad:

Weddings in India have become large-scale financial events. Families spend heavily on venues, jewellery, catering, décor and travel. In many urban and semi-urban settings, a lavish wedding is seen as a marker of social status. However, this growing scale has also increased financial vulnerability when unforeseen disruptions occur.

A Rs. 6.5 Lakh Crore Economy

Industry estimates suggest that wedding-related spending across the country touches nearly Rs. 6.5 lakh crore annually. Destination weddings, luxury resorts and overseas ceremonies have added new layers of cost. Despite this, insurance coverage for weddings remains extremely limited, with adoption estimated at well below one per cent.

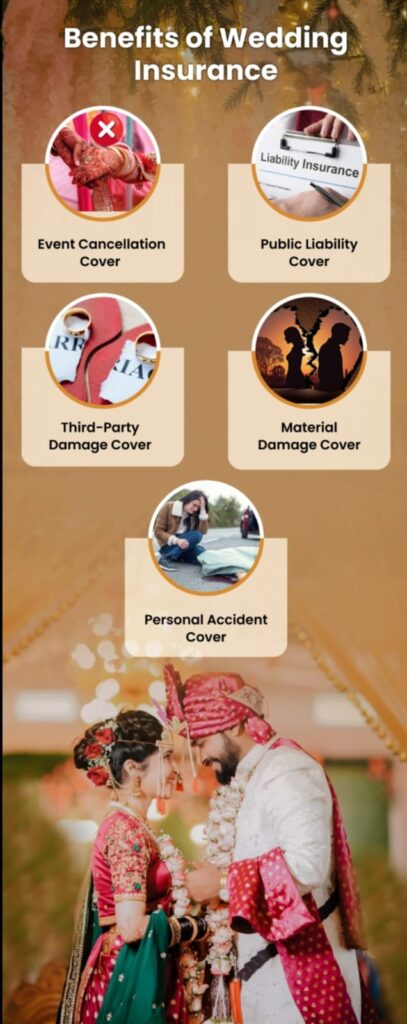

What Wedding Insurance Covers

Wedding insurance is designed to protect families from losses arising from cancellation, postponement or disruption. Coverage applies if ceremonies are called off due to medical emergencies, accidents or death in the immediate family. Losses related to venue bookings, decoration and vendor payments are typically included, subject to policy conditions.

Health and Food Safety Risks

In addition, policies also cover medical contingencies during wedding events. Food poisoning incidents affecting guests, sudden illness of the bride or groom, or hospitalisation during the ceremony period can trigger compensation. Such coverage has gained relevance as large gatherings increase health-related risks.

Safeguarding Valuables

Jewellery, wedding attire and other valuables are often exposed to theft, fire or accidental damage during ceremonies. Wedding insurance offers protection against such losses. Fire accidents at venues, damage to property, or theft reported through police complaints are generally eligible for claims, reducing the financial shock to families.

Affordable Premiums

The cost of coverage is relatively modest compared to overall wedding expenses. For a wedding budget of Rs. 10 lakh, premiums typically range between Rs. 2,000 and Rs. 5,000. Major insurers such as ICICI Lombard and HDFC ERGO offer customised wedding insurance plans tailored to different scales of events.

Claims that Built Confidence

During the pandemic, several families received settlements for weddings cancelled due to lockdowns and health restrictions. Insurers have also settled claims linked to fire accidents, theft of ornaments and sudden bereavement in the family. These cases have gradually improved trust in such policies.

Awareness Remains Low

However, awareness continues to be limited. Many families believe that buying wedding insurance is unnecessary or inauspicious. Experts note that this perception, rather than cost, is the primary barrier to adoption. In reality, insurance functions purely as a financial safeguard.

Digital Ease and Future Growth

Meanwhile, claim processes have become simpler with digital documentation and faster verification. Online policy issuance and technology-driven claims assessment have reduced delays. As wedding budgets continue to rise, insurance experts expect gradual growth in wedding insurance adoption, especially for high-value and destination weddings.

A Growing Need

Therefore, wedding insurance is increasingly viewed as a practical risk-management tool. In a sector involving massive spending and emotional investment, a small premium can provide significant financial reassurance. For families planning expensive ceremonies, insurance is emerging as a sensible addition rather than an afterthought.