Article Today, New Delhi:

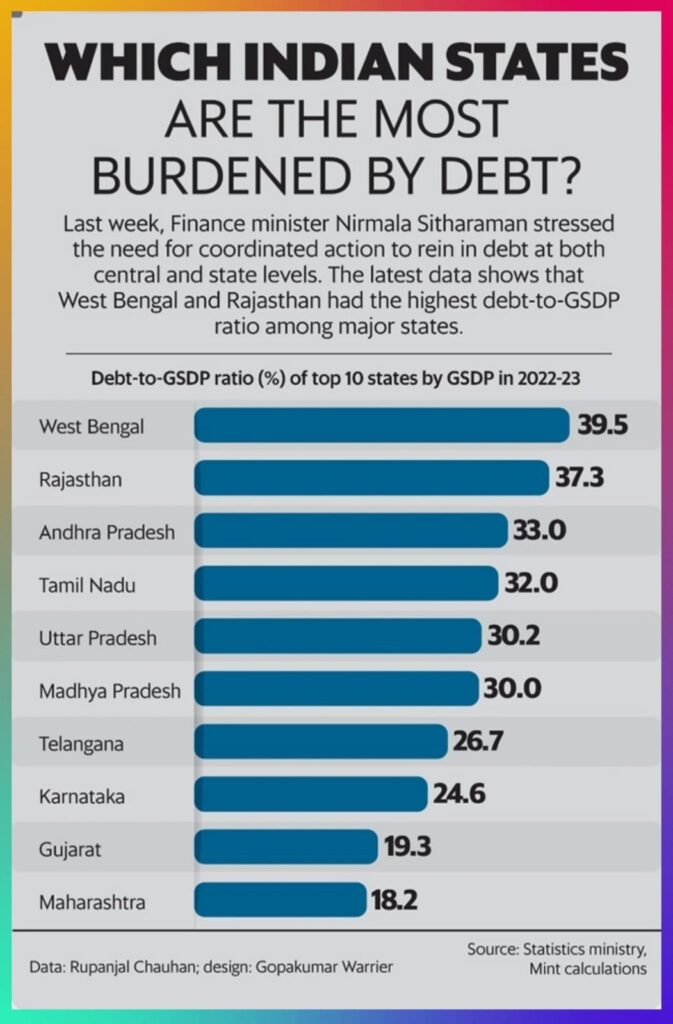

Several Indian States that once projected fiscal comfort are now facing mounting debt pressures. Expanded welfare commitments and sustained capital expenditure have sharply increased borrowings. Recent official data on debt-to-GSDP ratios has triggered a wider debate on the sustainability of State finances.

Southern States in Focus

Among the southern States, Andhra Pradesh stands out with a debt ratio of about 33 per cent, placing it among the top three nationally. Spending on welfare schemes over the past few years has relied heavily on borrowed funds. Telangana, with a debt burden of nearly 26.7 per cent, ranks seventh in the country. Large infrastructure projects undertaken after State formation continue to weigh on its finances. Political priorities, meanwhile, have further strained fiscal resources in both States.

Tamil Nadu and the Heartland

Tamil Nadu occupies the fourth position with debt close to 32 per cent of its GSDP. Despite a strong industrial base, borrowing has continued at a steady pace. Uttar Pradesh follows with about 30.2 per cent, reflecting the fiscal stress of a large population and extensive development spending. Madhya Pradesh reports a similar level, underscoring a broader pattern of expenditure exceeding revenue growth.

West Bengal Tops the List

West Bengal remains the most indebted among major States. Its debt ratio has reached nearly 39.5 per cent, indicating severe fiscal stress. A series of social welfare programmes has placed sustained pressure on the exchequer. Critics argue that weak fiscal discipline and politically driven spending have deepened the problem.

Rajasthan Close Behind

Rajasthan ranks second, with debt estimated at around 37.3 per cent of GSDP. Commitments made through earlier welfare promises continue to affect the State’s balance sheet. Limited avenues for revenue expansion, combined with high expenditure, have raised concerns about long-term fiscal stability.

Better Performers Emerge

In contrast, Maharashtra and Gujarat present a relatively stronger picture. Maharashtra has the lowest debt ratio at about 18.2 per cent, while Gujarat stands at nearly 19.3 per cent. Robust industrial activity and efficient revenue mobilisation have helped both States manage borrowings more prudently.

Central Warning Reiterated

Meanwhile, Union Finance Minister Nirmala Sitharaman has expressed concern over rising State debt. She has urged governments to remain within borrowing limits and maintain fiscal discipline. According to her, unchecked debt accumulation could eventually affect basic obligations, including salary payments. Therefore, sustained coordination between the Centre and States is essential to safeguard overall economic stability.